This year’s Global CEO Survey, the 27th we’ve conducted, suggests that the vast majority of companies are already taking at least some steps towards reinvention. Yet even as CEOs attempt meaningful changes to their companies’ business models, they are even more concerned about their long-term viability. Although the 4,702 CEOs responding to this year’s survey were more optimistic about global economic growth than last year, 45% of them are still not confident that their companies would survive more than a decade on their current path.

The stakes are high, but so is CEO awareness of both the urgency to change and the need to deliver sustained outcomes for stakeholders and society. To clarify the nature of the challenge and the opportunities associated with meaningful business reimagination, we’ve organised this year’s report in nine sections under three themes:

This section reviews the state of the economy and the anxiety among some CEOs about the long-term viability of their business models. The reinvention imperative

1. An enduring imperative to reinvent

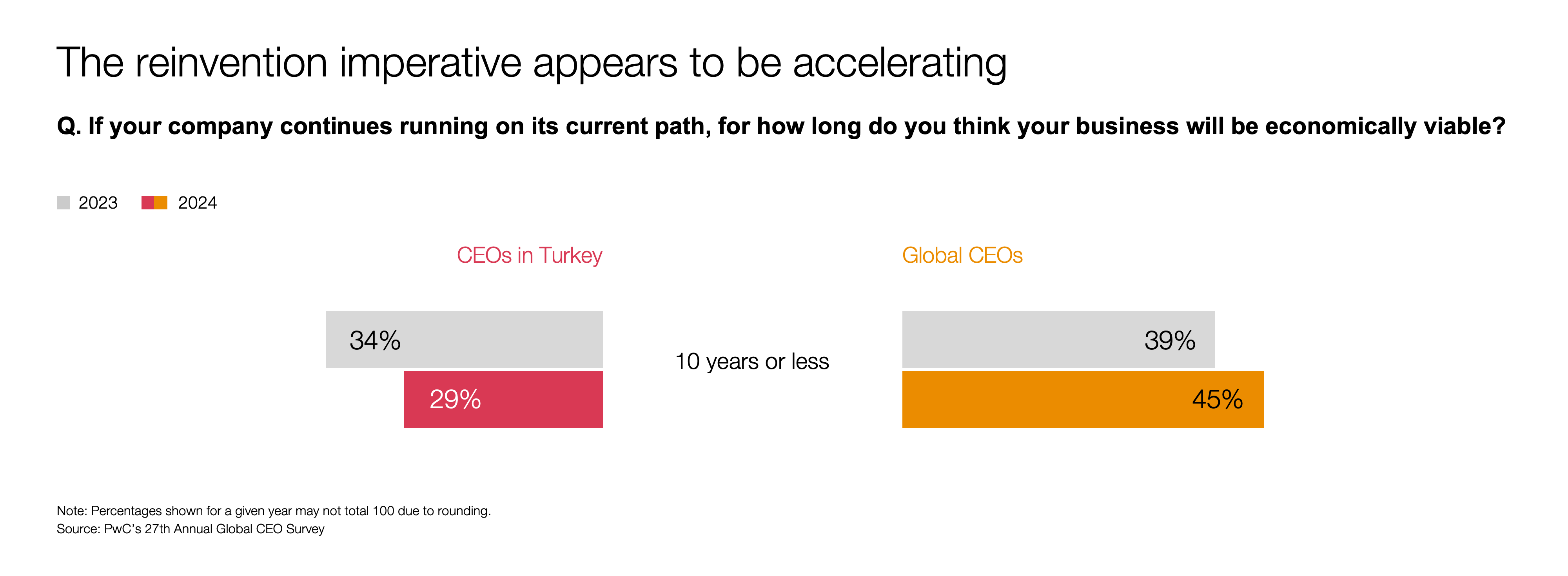

Technological disruption, climate change and other accelerating global megatrends continue to compel CEOs to adapt, as a whopping 97% of respondents to PwC’s 27th Annual Global CEO Survey report having taken at least some steps to change how they create, deliver and capture value over the past five years. During that span, 76% of CEOs took at least one action that had a large or very large impact on their company’s business model. That finding reflects a growing unease, as 45% of respondents doubted their company’s current trajectory would keep them viable beyond the next decade—up from 39% just 12 months earlier. The level of optimism among global and Turkish CEOs is very different. Compared to the last year, global CEOs are less optimistic about their companies’ viability for more than a decade if they continue on their current path.

29% of the Turkish CEOs responding to this year’s survey believe their companies will no longer be viable in ten years’ time if they continue on their current path, down from 34% last year.

2. Pressures and threats

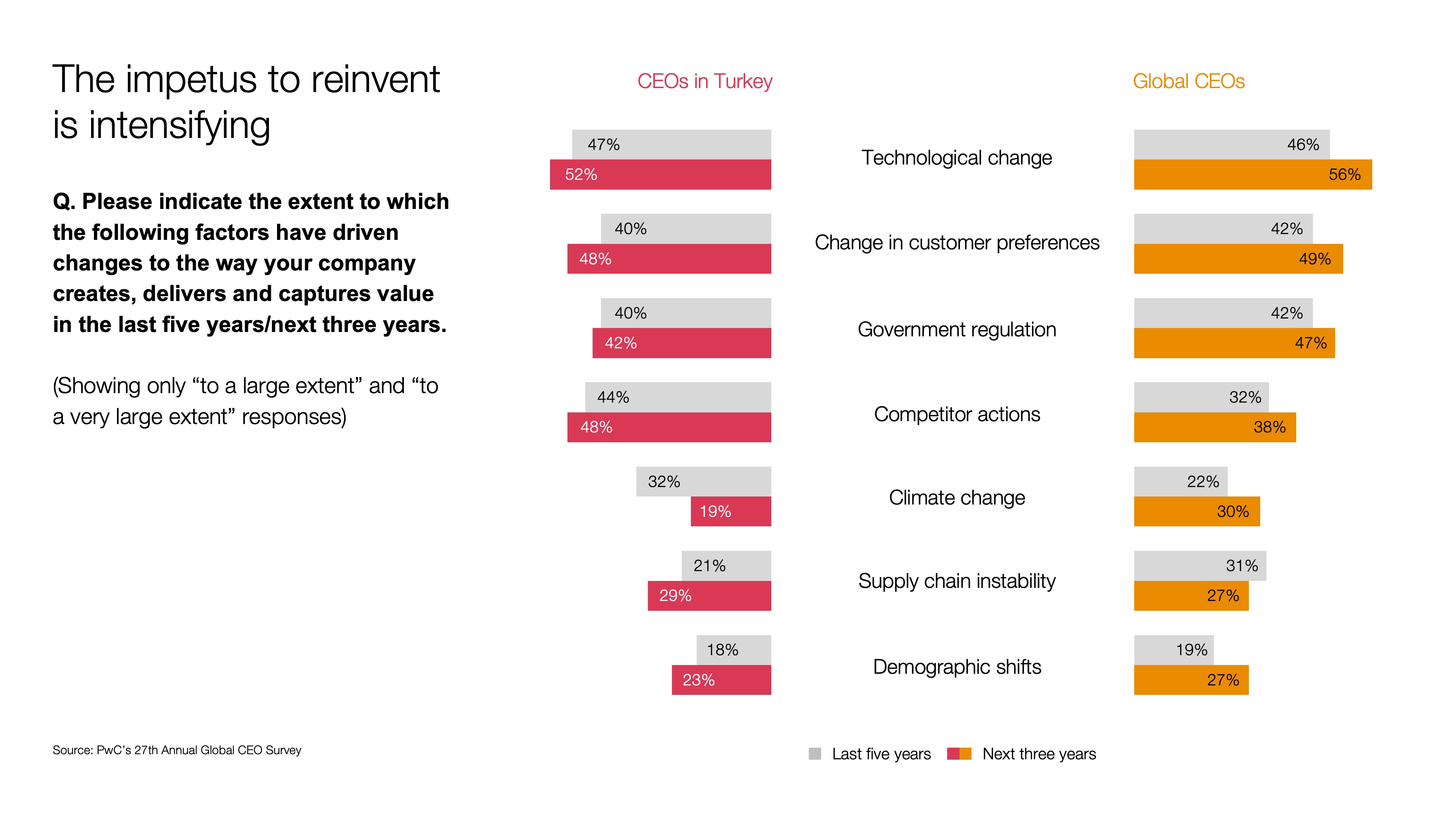

Another sign that the need to reinvent is rising is a notable increase in the pressure CEOs expect over the next three years from factors that influence business model change. Compared to the last five years, for example, CEOs expect changes associated with technology, customer preferences and climate change, among others, to have a far larger impact on the way they create, deliver and capture value. Only the impact of supply chain instability declines in relative terms as CEOs look ahead to the next three years.

Inflation remains the top concern for Turkish CEOs, with 56% ranking it at the top of their lists. Last year, 74% of Turkish CEOs believed their companies would be ‘highly exposed’ or ‘extremely exposed’ to inflation risk. In parallel with the current financial trends in Türkiye, macroeconomic volatility ranked second, with 44% of Turkish CEOs stating it as a risk factor. (Global CEOs: 24%). Even though the percentages seem more optimistic than last year, these risks still rank high.

Turkish CEOs are still concerned about health risks, however, 40% believe they will be slightly exposed to health risks compared to 27% of global CEOs. Turkish CEOs are more likely to believe they will be exposed to geopolitical conflicts (27%) than global CEOs.

This section examines the status of two megatrends—climate change and technological disruption (exemplified here by generative AI)—which are poised to spur further reinvention. Looming existential change

3. Planetary work in progress

Among the megatrends pressuring CEOs to reinvent themselves, none is more important than climate change. Here, CEOs report mixed success at meeting their stated objectives. Roughly two-thirds have efforts underway to improve energy efficiency; another 10% report completing such initiatives; and about half say they have work in progress to innovate climate-friendly products or services. CEOs in Western Europe are more likely to have energy efficiency and climate-oriented innovation initiatives in progress or completed. And CEOs everywhere are accepting lower hurdle rates \for climate-friendly investments.

4. The AI opportunity

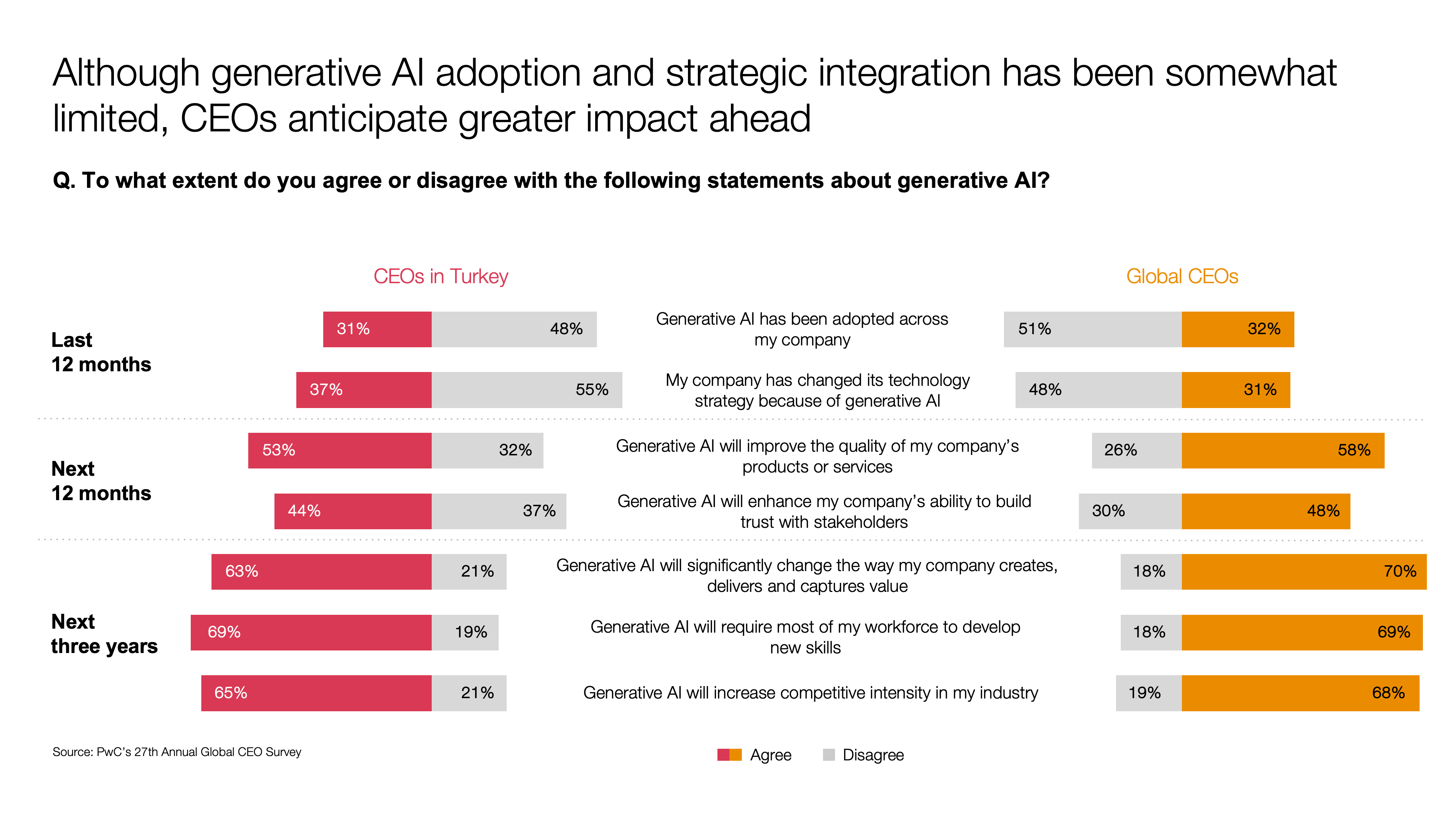

CEOs in this year’s survey appear to believe in both the fast pace of generative AI adoption and its outsized potential for disruption. For example, over the next year, about half of CEOs expect generative AI to enhance their ability to build trust with stakeholders, and about 60% expect it to improve product or service quality. Within the next three years, nearly seven in ten respondents also anticipate generative AI will increase competition, drive changes to their business models and require new skills from their workforce. So far, experience apparently buoys expectations. CEOs who say they have adopted generative AI across their company (about one-third of our sample) are significantly more likely than others to anticipate its transformative potential over the next 12 months, as well as over the next three years. More than 60% of both Turkish and global CEOs expect generative AI to boost their workforce efficiency in the next 12 months , and more than half expect it to improve their own efficiency.

The CEOs responding to this year’s survey think both the adoption rate and transformative potential of generative AI are very high. 69% of both Turkish and global CEOs believe they must upskill their company workforces to adopt generative AI in the next three years.

31% of Turkish CEOs said they have adopted generative AI in the last 12 months, while 48% said they haven’t. 37% of Turkish CEOs reported having shifted their technological strategy to generative AI due to its potential benefits (Global CEOs: 31%).

5. The AI challenge

Even as the momentum of generative AI surges, a range of experts in the field are voicing concerns over the potentially significant, unintended consequences that could emerge as its reach grows. CEOs reflected similar sentiments in their responses to the survey. Consider, for example, that when it comes to generative AI, CEOs are most concerned about cybersecurity risk—and over half agree that it is likely to increase the spread of misinformation in their company. One-third of CEOs also expect generative AI to increase bias towards specific groups of employees or customers in the next 12 months. Almost as many disagree, suggesting bias is likely to be an area of growing attention as the scope and complexity of generative AI’s role in business expands. Interestingly, familiarity with generative AI does not seem to mitigate concerns about the risks among CEOs whose companies have already broadly adopted it. Cyber security risks top Turkish CEOs’ concerns about AI (63%), followed by the spread of misinformation (44%). These two concerns are common for global CEOs.

This section outlines four essential actions to jump-start continuous reinvention. Your reinvention playbook

6. Turn barriers into opportunities

We asked CEOs about a range of obstacles they often confront when undertaking large-scale corporate change efforts. Their responses underscore that many constraints are sector-specific. Infrastructure challenges, for example, inhibit reinvention (to a moderate extent or more) in energy, power and utilities, and transportation and logistics (61%, 58% and 56%, respectively, compared to the global average of 37%). We also saw that CEOs who are more concerned about the viability of their companies were more likely to flag the existence of reinvention obstacles. Yet, it is surprising that such a small number of CEOs understand the massive impact of some barriers. For example, only 25% of CEOs described lack of support from the board as even a moderate constraint on their reinvention efforts, and only 30% of CEOs said the same of internal stakeholders. Similarly, lack of support from their boards should not be a constraint for decarbonisation for Turkish CEOs.

7. Pinpoint your most important moves

Actual progress will come when leaders and companies undertake meaningful initiatives to evolve the way they create, deliver and capture value. Analysis of this year’s survey data showed a positive association between self-reported profit margins and business moves that had a large or very large effect on respondents’ business models—such as technology development and deployment, novel pricing models, and strategic partnerships. This was true both of individual reinvention actions and of a composite reinvention index that we created. The data suggests that returns are three to five percentage points higher for actions with a very large impact on business models than those with limited impact.

8. Recalibrate expectations for climate priorities

As CEOs establish priorities, many are seeing climate change as an industry disruptor containing distinct opportunities in addition to risks. Nearly one-third expect climate change to alter the way they create, deliver and capture value over the next three years—compared to less than one-quarter, who said as much regarding the past five years. This may partly explain why 41% of CEOs, including over half of those at chemical companies, say their companies have set lower hurdle rates for climate-friendly investments than for other investments. Geographically, CEOs in Asia-Pacific are more likely than those elsewhere to have accepted lower hurdle rates, even though they were no more likely than CEOs elsewhere to report feeling highly or extremely exposed to climate change.

9. Keep your antennae up

Those CEOs who are less confident in their company’s viability are more conscious of the threats they face. Whether that’s because they are at greater risk from those threats or because they’re seeing something other companies don’t probably varies by company, industry and geography. PwC’s Global Internal Audit Study 2023 highlights how effective a company’s risk, compliance and internal audit teams can be at putting in place the early-warning and risk-sensing systems to help spot these hazards.

Sustaining the change

The totality of this year’s survey results reflects an awareness among CEOs that they are navigating critical strategic inflection points, and feel a sense of urgency and a bias towards action. The data also suggest there’s a growing premium on leadership effectiveness to maintain energy, challenge the status quo and increase momentum.

What’s more, CEOs need a plan to communicate the urgency they are feeling, so that everyone understands and can potentially own part of the solution. People who are proficient at their current jobs may resist change because they’re concerned they may not be good at what they’ll be required to do in the future. So CEOs who are serious about reinvention must find approaches for acknowledging concerns, prizing curiosity and openness to learning, and encouraging managers to help people adapt.