This paper explores the concept of the “Green Premium (GrPr)” and its implications for businesses amidst global efforts to combat climate change. As governments adopt stricter emissions policies and stakeholders promote sustainability, businesses face heightened transition risks, including increased costs, regulatory uncertainties, and technological challenges. Effective strategies are essential to proactively manage and mitigate these risks.

Within the green transition landscape, two strategic paths emerge: Carbon Players adopt a cautious, incremental approach to decarbonization, optimizing operations while considering trade-offs. Conversely, Green Pioneers pursue sustainable business models, aiming for early market dominance and benefiting from access to green markets, regulatory risk mitigation, and green finance opportunities. Thus, Green Pioneers leverage first-mover advantages, using sustainable innovation to tap into emerging green markets and benefit from a GrPr.

GrPr reflects the tangible and intangible benefits associated with transitioning products, services, business models, markets, and ecosystems towards more sustainable practices. Companies embracing higher levels of sustainability enjoy benefits like higher product prices, enhanced brand reputation, access to exclusive markets, green funding opportunities, and regulatory resilience. Furthermore, leveraging GrPr offers a proactive approach to avoid or mitigate transition costs such as increasing cost of carbon, stringent legal and regulatory risks, and technological shifts.

Unravelling the Global Climate Change: Developments, Challenges, and Strategic Choices

The dawn of the 21st century has witnessed an unprecedented acceleration in global climate change characterized by profound environmental, economic, and social challenges. In response, nations worldwide have come together in a unified effort to combat its effects. Alongside the Paris Agreement, various regional and national initiatives have sprouted forth, reflecting the diverse strategies adopted by countries to tackle climate change head-on. The private sector is also engaged, with numerous companies taking action under the Science-Based Targets Initiative (SBTi) and similar efforts to foster decarbonization.

Despite these efforts, the path to achieving ambitious targets is riddled with challenges. The transition to a sustainable future demands a fundamental shift in consumer behavior, market dynamics, and the development of green energy infrastructure. High costs, evolving technologies, and inadequate financing pose significant barriers that deter private sector engagement in emission reduction. Consequently, companies find themselves at a crossroad, compelled to make strategic decisions.

In this dynamic landscape, strategic choices can be broadly categorized into two main camps: the trailblazers, pioneering the transition toward a more sustainable business model (referred to as Green Pioneers), and those opting for a more cautious, incremental approach to decarbonization while optimizing existing markets and operations (referred to as Carbon Players). While each strategic choice entails trade-offs, it also offers significant opportunities for actors to tap into potential growth and stimulate competitiveness.

These strategic choices offer substantial opportunities for those players spearheading sustainable business strategies. Among the primary advantages for Green Pioneers is the prospect of capitalizing on a "Green Premium (GrPr) by driving sustainable innovation, meeting evolving market demands, and creating long-term positive financial value.

Mitigating the Transition Cost through Green Premium

As the profound adverse effects of climate change are being witnessed globally, stricter policies aimed at decreasing and mitigating climate risks are being adopted. Understanding and managing these transition risks is essential for businesses to navigate the complexities of emission mitigation and align their strategies with global sustainability goals. Leveraging GrPr becomes crucial in this context, offering a proactive approach to avoid or mitigate transition costs such as increasing cost of carbon, stringent legal and regulatory risks, and technological shift. By addressing these factors strategically and integrating GrPr strategies successfully into their business models, companies can navigate the transition effectively, mitigate financial risks and position themselves advantageously in a rapidly changing economic and regulatory environment.

Investment and Cost Imperatives of the Green Transition

In the pursuit of a sustainable future, global capital expenditures and investments play a crucial role in limiting global warming and mitigating its associated risks. Estimates of the total cost of the green transition range from $100 trillion to $300 trillion by 2050, according to various studies. Despite the wide range of these estimates, it is clear that achieving green transition will require substantial financial commitments and significant investments. Considering the diverse characteristics of different sectors and regions, investment needs and costs vary significantly, each presenting unique challenges and opportunities.

From a broader perspective, regardless of sector-specific needs, there are overarching areas that require investment in the green transition journey. Investments in new technology and equipment is pivotal for upgrading existing systems and developing more efficient ones. In this context, research and development activities play a crucial role in advancing new technologies and improving existing ones, ensuring continuous innovation and cost reduction. Consequently, testing and certification of new green products and services are essential to ensure they meet regulatory standards and perform as expected, which is vital for market acceptance and deployment. Lastly, upskilling and reskilling the workforce is necessary to equip them with the skills required to operate and maintain new technologies and systems, fostering a smooth transition to a green economy.

Investing Strategically: Balancing Costs, Benefits, and Return of Investment

To fully capitalize on the advantages inherent in the GrPr, companies aspiring to lead the green landscape must prioritize strategic investments in their green investment portfolios. In this endeavor, understanding the role of return on investment (ROI) emerges as imperative. Various factors affect the cost-effectiveness of investments and subsequent returns. Initial investments may require significant capital, varying based on company size and sector, particularly in carbon-intensive sectors where positive ROI may take longer to achieve. Additionally, location and the energy mix —whether reliant on fossil fuels or abundant in renewable energy sources—significantly impact decarbonization strategies.

The interplay between the cost of decarbonization and the GrPr guides companies on when and to what extent decarbonization efforts yield positive returns. It indicates that optimal results can be achieved by investing up to the maximum ROI point, while proceeding beyond this juncture may result in increased costs and diminished returns. However, those adopting a more cautious approach may focus on aligning decarbonization efforts with the maximization of ROI. Companies committed to ambitious decarbonization strategies may choose to go beyond this juncture. Amidst the financial hurdles entailing decarbonization, strategic investments play a paramount role in carefully balancing costs against benefits.

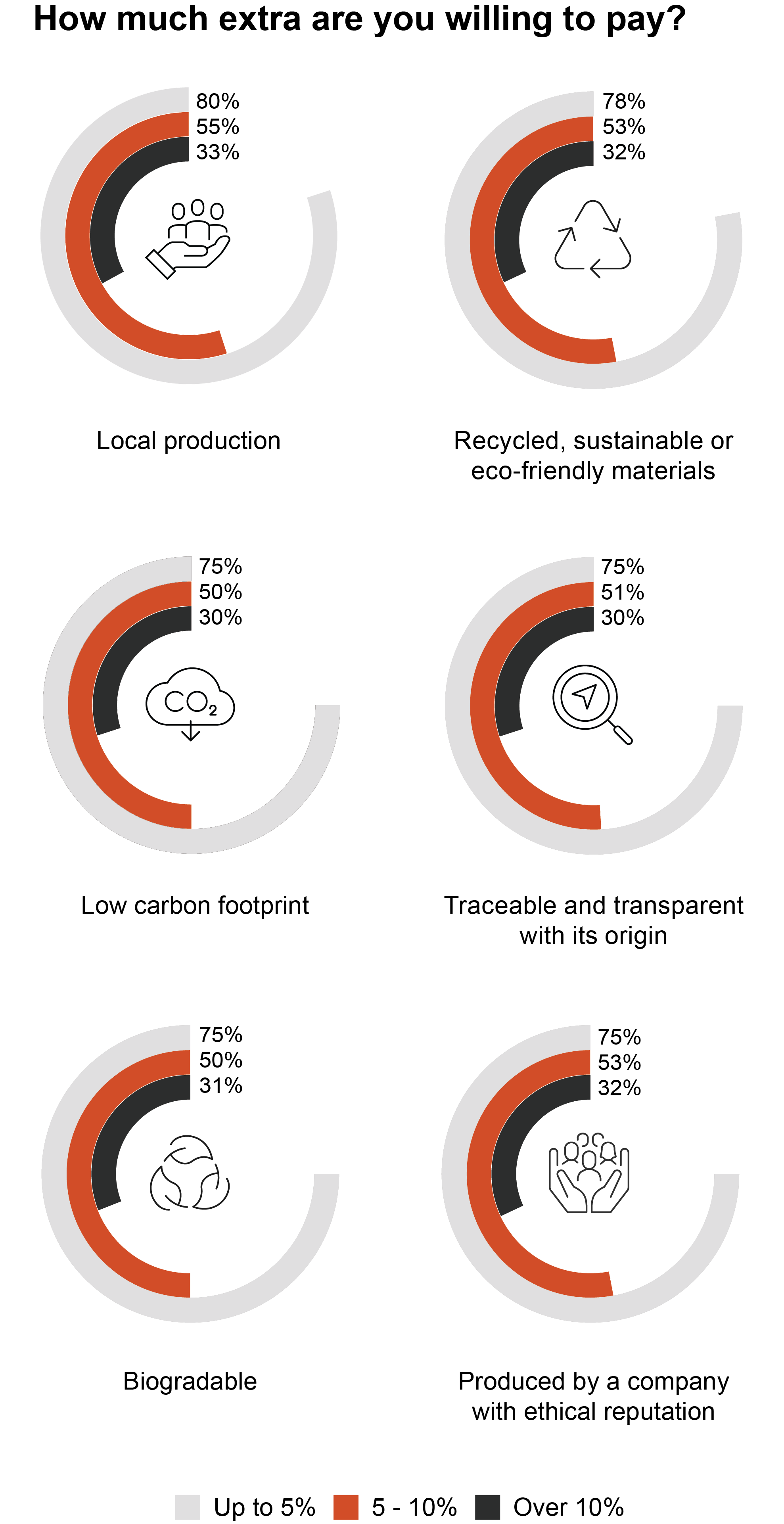

In this context, both cost and green premium curves should be perceived as dynamic and subject to change over time. For instance, technological advancements can drive the cost curve downward as novel green technologies become more affordable and scalable. Moreover, market changes such as increased demand for green products, stricter carbon taxes, and broader access to low-cost financing can elevate the GrPr curve. These factors emphasize the need for companies to stay informed, adaptable, and agile in their strategies. On the other hand, maximizing the GrPr comes with certain limitations. As a company's GrPr increases, the market and client base for such products or services tend to narrow. At its peak, these offerings often appeal only to a niche market. However, the market for sustainable and green products is expected to expand over time, boosting both supply and demand for high-quality green products. This growth will likely come with a higher willingness to pay a premium for access to these environmentally friendly options.

Conclusion

In conclusion, the GrPr offers a strategic pathway for businesses to navigate the complexities of transitioning towards sustainability. By adopting comprehensive GrPr strategies tailored to their industries, geographical contexts, and product offerings, companies can mitigate financial risks, enhance business resilience, and capitalize on emerging opportunities in a carbon-constrained economy. Effectively leveraging the GrPr supports environmental stewardship and strengthens long-term profitability and competitiveness in a sustainable future.

Navigating the complexities of transitioning to a low-carbon economy requires adopting a strategic, value-based approach that considers potential benefits and costs. It is essential to recognize the broader societal impacts and opportunities associated with sustainable practices. Embracing sustainability not only mitigates environmental risks but also fosters social responsibility and enhances community resilience. Companies that prioritize sustainability initiatives contribute to job creation, economic development, and improved public health outcomes, generating positive ripple effects beyond their immediate operations. By aligning environmental stewardship with social and economic well-being, businesses can build greater trust and collaboration with stakeholders, enhancing their overall reputation and long-term sustainability.

Competitive Differentiation in Green Transition: The Significance of Green Premium (GrPr)

Contact us