{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

As in the rest of the world, the asset and wealth management industry in Turkey is growing, and regulations, compliance, risk management, reporting and taxing are becoming bound by more rigid and complex laws. Investors prefer easy-to-access solutions, more trustworthy service providers and more transparent investment products. Investors need and are interested in alternative asset classifications and investment products, having their portfolios managed professionally and collective investment tools based on risk allocation principles.

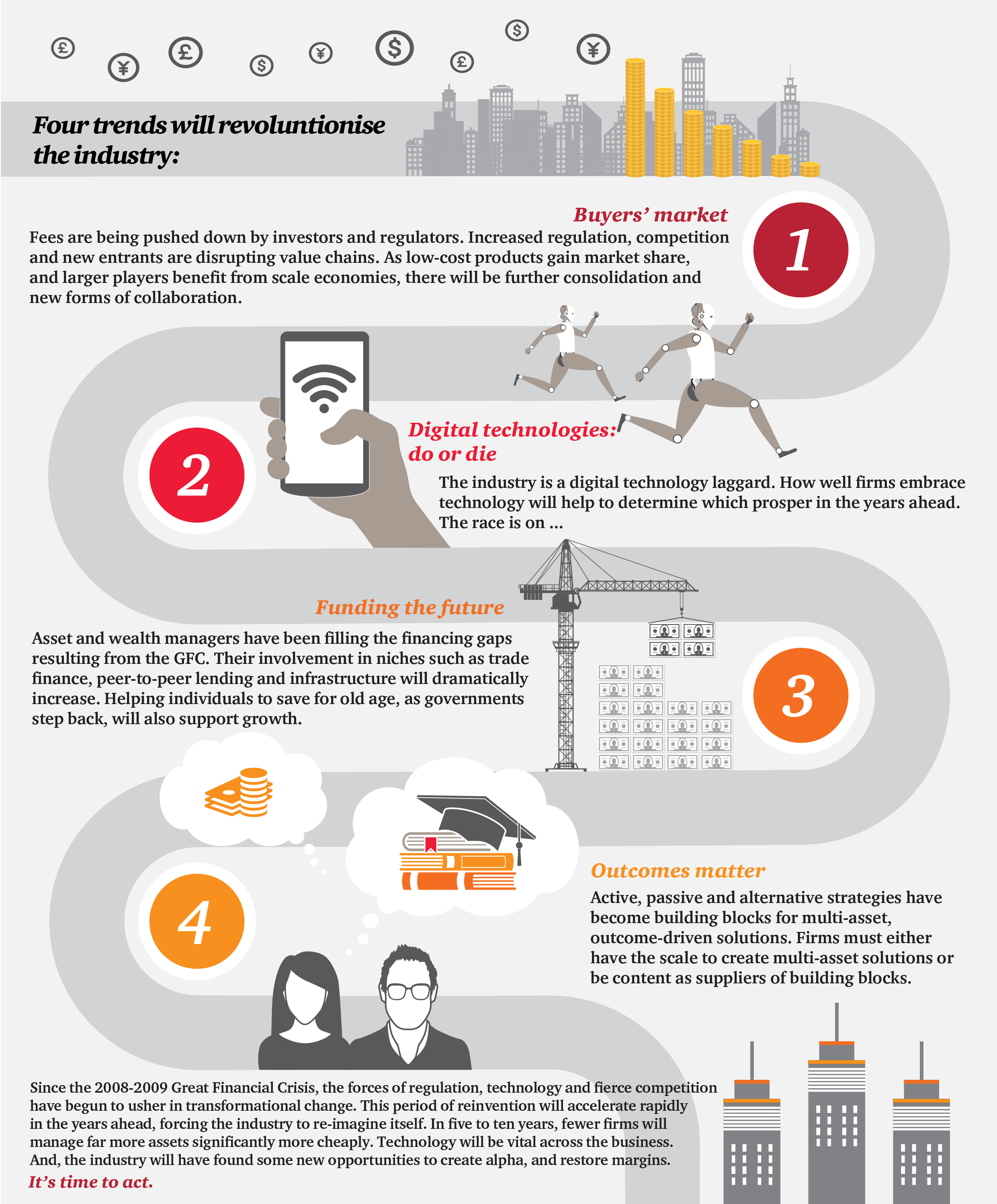

Moreover, we predict that managers who can diversify solutions, products and services and provide customer-oriented service as well as manage risks and costs of investors well and follow regulations will prevail in an atmosphere of strong competition.

At PwC we support the future of all our clients of all sizes with tax planning, set up of various investment structures and funds, processes and reporting infrastructure, FATCA and CRS compliance, governance, support for choosing and improving IT infrastructure, auditing and strategy with our global network of specialists.

Assets under management (AuM) will continue to grow rapidly. We estimate that by 2025 AuM will have almost doubled – rising from US$84.9 trillion in 2016 to US$145.4 trillion in 2025.